Mississauga Land Transfer Tax Advantage Over Ontario

Table of Contents

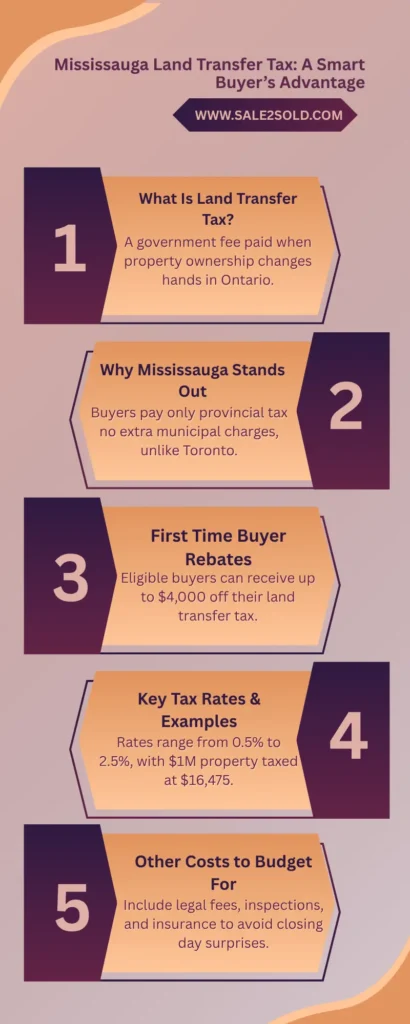

ToggleBuying a home is an exciting step, but it comes with costs beyond the purchase price. One of the most significant is the land transfer tax, a fee paid to the government whenever property ownership changes hands. Many buyers overlook it when budgeting, only to be surprised at closing. For anyone purchasing in Mississauga, understanding how this tax works can save time, stress, and money. The Mississauga Land Transfer Tax stands out because it is simpler and often cheaper compared to certain other cities in Ontario. This advantage can make a real difference, especially in today’s market where every dollar counts.

In Ontario, the land transfer tax is set by the province, and the amount you pay is based on the value of the property. It’s a progressive tax, meaning the higher the property value, the more tax you pay. The tax is calculated in tiers, meaning each rate applies only to the part of the property price that falls within its range.

The current rates are:

For example, a property purchased for $1,000,000 results in a tax bill of $16,475. This is calculated by adding up the tax from each bracket. The buyer must pay this amount to the provincial government at the time the property is registered in their name. This is not an optional fee; it’s a mandatory part of the transaction.

The Mississauga Land Transfer Tax is straightforward. Buyers here pay only the provincial tax there’s no additional municipal charge. This sets Mississauga land transfer tax apart from places like Toronto, where buyers face a second layer of taxation.

For example, on a $1,000,000 home in Mississauga, the buyer would pay $16,475 in land transfer tax. In Toronto, the buyer pays both the provincial tax and an equal municipal tax, bringing the total to $32,950. That’s a difference of over $16,000, just because of where the property is located.

This simplicity makes Mississauga land transfer tax attractive to buyers who want to stay close to Toronto but avoid unnecessary extra costs.

It’s clear that the Mississauga Land Transfer Tax structure offers an advantage, but how does it compare to other Ontario markets? Ottawa, like Mississauga land transfer tax, only charges the provincial tax, so buyers there pay the same amount. However, Toronto’s municipal tax nearly doubles the total.

CityHome PriceProvincial LTTMunicipal LTTTotal LTT

Mississauga $1,000,000 $16,475 $0 $16,475

Toronto $1,000,000 $16,475 $16,475 $32,950

Ottawa $1,000,000 $16,475 $0 $16,475

This difference influences where buyers decide to purchase. For those who want to save on closing costs while still having access to major city amenities, Mississauga land transfer tax is a clear winner.

Ontario supports first time buyers by offering a land transfer tax rebate. If you’re eligible, you could get a rebate of up to $4,000 on the provincial tax. To qualify, you must have never owned a home anywhere in the world, and you must intend to live in the property as your primary residence.

For example, purchasing a $500,000 home in Mississauga would typically result in a land transfer tax of $6,475. With the rebate, you only pay $2,475. This program helps new buyers ease the financial burden of purchasing their first property. The rebate is applied automatically by your lawyer when registering the deed.

While the Mississauga Land Transfer Tax applies to most transactions, there are some exemptions. Property transfers between spouses as part of a divorce or separation often qualify for relief. Inherited properties can also be exempt, depending on the circumstances. However, it’s important to note that investment properties do not benefit from rebates or exemptions. Investors must pay the full amount, which should be factored into their purchase calculations.

Understanding these exemptions in advance can prevent surprises and help you budget more accurately.

Calculating the tax doesn’t require complicated math. You apply each rate to the portion of the property price that falls into that bracket. Here are a few examples:

These calculations show how quickly the tax rises with property value. Using an online calculator can save time, but understanding the numbers helps you make more informed decisions.

The most significant benefit of buying in Mississauga is the absence of a municipal land transfer tax. This means buyers keep thousands of dollars that would otherwise go to city coffers in other markets. For families stretching their budgets, this saving can be crucial.

Investors also benefit. By avoiding double taxation, they improve their return on investment. The savings can go toward renovations, furnishings, or even serve as a cushion for unexpected expenses. This advantage makes the Mississauga Land Transfer Tax a key consideration for anyone comparing markets.

While the mississauga land transfer tax is a significant expense, it’s not the only cost buyers face. Closing involves several other fees, including:

When combined, these expenses can add several percent to the property price. Budgeting for all of them, not just the land transfer tax, ensures a smoother purchase process.

There is always the question of whether growing cities will introduce new taxes to generate revenue. If Mississauga were to implement a municipal land transfer tax, the cost advantage it currently enjoys would disappear. While there’s no sign of this happening soon, market watchers keep an eye on policy changes.

For now, buyers can take advantage of this favorable situation and enjoy lower closing costs compared to other parts of the Greater Toronto Area.

Real estate professionals emphasize that closing costs influence affordability as much as home prices. Even a $10,000 to $15,000 difference can impact whether someone qualifies for a mortgage. The Mississauga Land Transfer Tax advantage gives buyers more flexibility. For first-time buyers, it may be the difference between buying now and waiting. For investors, it directly improves profit margins. This is why many experts highlight Mississauga as a strategic location for purchases.

The Mississauga Land Transfer Tax structure provides a clear financial benefit. Buyers only pay the provincial tax, avoiding the additional municipal charge seen in other markets. This saves thousands of dollars and simplifies the buying process. Whether you’re a first time buyer or an experienced investor, understanding this advantage can help you make smarter decisions. Planning, using available rebates, and working with knowledgeable professionals ensures you get the most out of your purchase.