How to Save Money Selling Your Home in 2025

Selling your home in 2025 can feel like a monumental task, especially with fluctuating interest rates, increasing inventory, and changing market dynamics. However, it doesn’t have to be a financial burden. With smart planning and the right approach, you can save money selling your home while still attracting qualified buyers and achieving a successful sale.

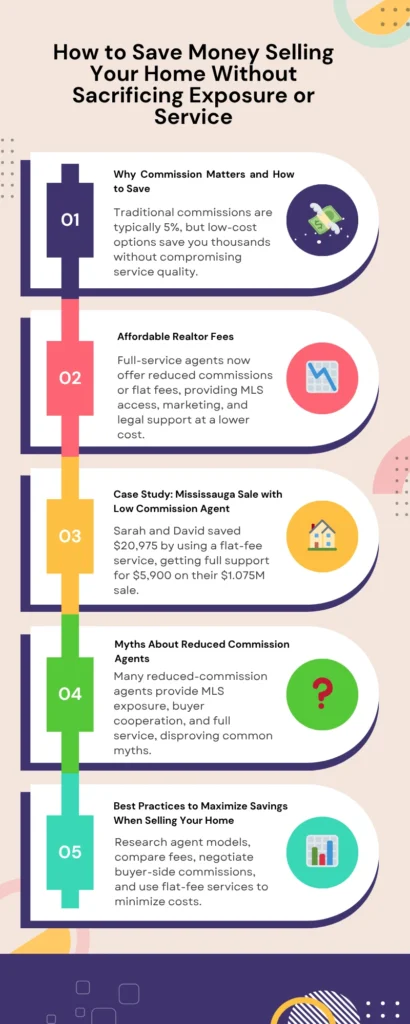

This comprehensive guide offers practical strategies to reduce costs throughout the selling process from hiring the right professionals to cost effective upgrades and marketing. Here’s how to save money selling your home without compromising results.

Table of Contents

ToggleOne of the most effective ways to save money selling your home is by choosing the right real estate agent. Many sellers focus solely on commission rates, but the true value lies in an agent’s experience, market knowledge, and negotiation skills.

Accurate Pricing: A seasoned agent understands market trends and can help you price your home properly. Accurate pricing attracts buyers faster and reduces the risk of price drops later.

Targeted Marketing: Skilled agents know how to promote your listing across digital platforms, ensuring you reach a broad audience without spending excessively.

Stronger Negotiations: An agent who’s a confident negotiator can secure better terms and help you walk away with more money in your pocket.

In the long run, a great agent can help you avoid common pitfalls, sell your home faster, and ultimately save money selling your home.

Home staging increases your home’s appeal, but it doesn’t have to cost thousands. Virtual staging offers a low cost, high impact alternative that allows you to save money selling your home while presenting it in the best light.

Budget-Friendly: At $30 to $50 per image, virtual staging is significantly cheaper than traditional methods.

Customizable and Quick: You can easily change room styles, layouts, and furnishings to suit your target buyer. Plus, it’s completed in 24 48 hours.

Virtual staging is a modern, efficient tool that enables sellers to create beautiful listings and save money selling your home without the physical hassle.

You don’t need to undertake major renovations to increase your home’s value. In fact, some of the best updates are small and inexpensive. If you’re trying to save money selling your home, focus on improvements with the highest return.

Kitchen & Bath Refresh: Update cabinet handles, light fixtures, and faucets for a new look without a full remodel.

Energy Efficiency: Install smart thermostats, replace old windows, or add insulation to appeal to eco conscious buyers.

Boost Curb Appeal: Clean the yard, repaint the front door, and power wash walkways. These little touches can make a big first impression.

These upgrades not only improve your home’s presentation but also allow you to save money selling your home by avoiding overpriced renovations.

Getting the price right is key. Overpricing can leave your home sitting unsold, leading to reductions and delays. Strategic pricing can shorten time on market and help you save money selling your home by reducing holding costs like taxes and utilities.

Research Comparable Sales: Look at similar homes recently sold in your neighborhood.

Work With Your Agent: A knowledgeable agent will use current market data to recommend the ideal asking price.

Avoid Price Drops: Homes priced right from the start often attract more serious buyers and receive multiple offers.

Correct pricing is one of the simplest and most effective ways to save money selling your home while maximizing your profit.

Marketing your home doesn’t have to be expensive. While traditional ads are costly and outdated, digital marketing can help you save money selling your home while still reaching a wide audience.

Professional Photography: Quality photos are essential and often included with agent services. They make your listing stand out online.

Social Media Sharing: Platforms like Facebook and Instagram are free to use and allow you to promote your listing to local buyers.

Online Listings: List your property on popular real estate platforms that attract motivated buyers and offer wide visibility with minimal cost.

These strategies help you market effectively and save money selling your home by reducing advertising costs.

Moving can be one of the largest out of pocket expenses during the selling process. However, with proper planning, you can save money selling your home by reducing moving related costs.

DIY Your Move: Rent a truck and do the packing and moving yourself or with help from friends and family.

Use Free Packing Materials: Get boxes from local stores or online marketplaces, and use old towels to wrap fragile items.

Compare Quotes: If you’re hiring movers, request estimates from several companies and look for off season discounts.

Being resourceful during the moving process is another smart way to save money selling your home and reduce overall costs.

If you’re confident in your sales skills and want to avoid paying full commissions, selling your home as a For Sale By Owner (FSBO) or to a cash buyer might help you save money selling your home but there are trade offs.

Pros: No listing agent commission, full control over the process, and flexible negotiations.

Cons: Limited exposure, more responsibility for showings, and legal paperwork.

Cash buyers offer quick closings with no financing contingencies or inspections, which could save time. However, they typically offer below market prices.

If done carefully, both options can help you save money selling your home just be sure to weigh the risks and consult professionals when needed.

Closing costs can catch sellers by surprise if not planned for early. Being proactive about these fees can help you save money selling your home by avoiding last minute stress or financial strain.

Land Transfer Tax: If you’re in cities like Toronto, you may owe both provincial and municipal taxes.

Capital Gains: If your property isn’t your primary residence, profits may be taxable.

Setting aside 1.5% of the home’s sale price for closing expenses is a good rule of thumb. Being prepared helps you manage your finances and save money selling your home more effectively.

Selling your home in today’s market doesn’t have to be overwhelming or expensive. By being strategic with pricing, choosing the right professionals, investing in small improvements, and leveraging digital tools, you can save money selling your home without cutting corners.

Whether you hire a full service agent, go FSBO, or consider a fast cash sale, the goal is the same: sell your home quickly, efficiently, and profitably. Use the tips in this guide to make smarter decisions and save money selling your home every step of the way.