How to Calculate Rental Yield : A Guide for Mississauga Investors

Table of Contents

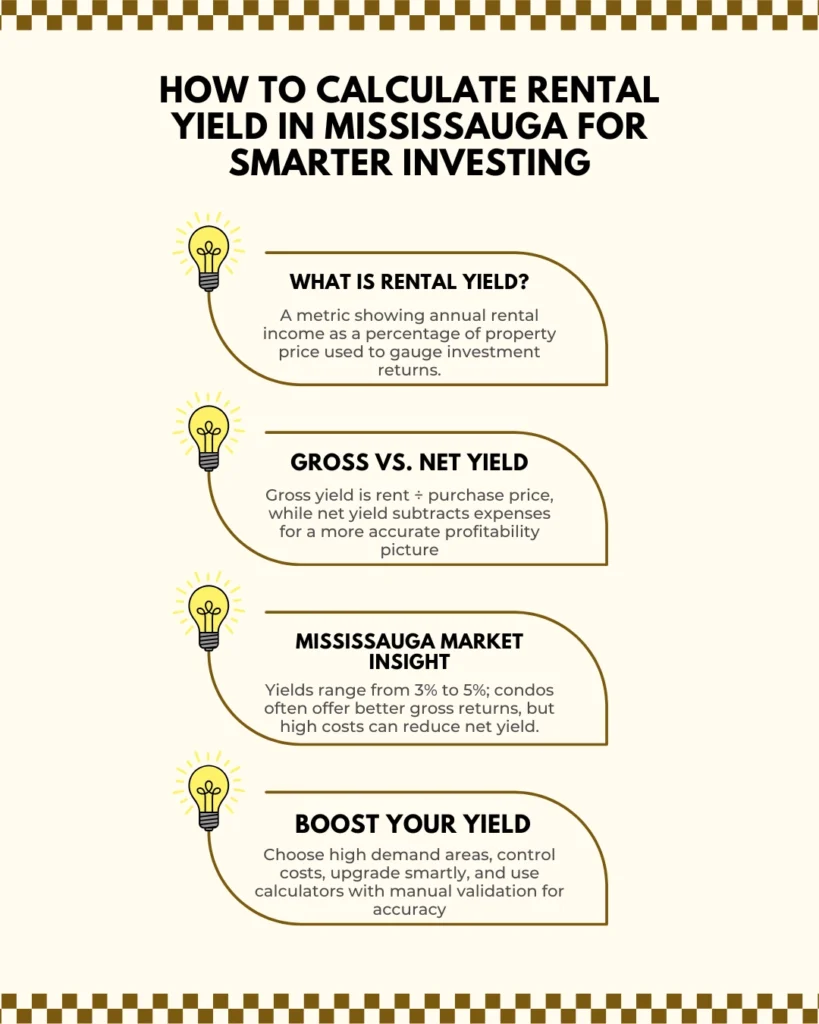

ToggleWhen it comes to real estate investment, understanding how to calculate rental yield can make the difference between a profitable property and a poor investment. Rental yield indicates the yearly return a property earns, shown as a percentage of its purchase price. It helps investors see how much income the property produces relative to what they paid for it. In Mississauga, where property prices continue to rise and rental demand remains strong, being able to calculate this figure accurately is crucial. Whether you own a condo, a detached home, or a townhouse, knowing how to calculate rental yield helps you make better financial decisions.

Rental yield is a metric that shows how well a property generates income. It is an essential metric because it goes beyond property appreciation and focuses on cash flow. When you calculate rental yield, you determine whether the rent collected each year justifies the money you have tied up in the property.

There are two main types:

For investors, both numbers matter. Gross yield helps with quick comparisons, while net yield shows the actual profitability after all costs are factored in.

Mississauga is a high demand market where prices are often over $1 million for detached homes, and rental rates for even one bedroom units hover around $2,000. In such a competitive environment, being able to calculate rental yield correctly ensures you are not overpaying for low returns.

For example, two properties may have similar rents, but if one costs significantly more to buy or maintain, its yield will be lower. Investors who take the time to calculate rental yield can spot these differences and choose properties that generate stronger cash flow. Additionally, yield analysis allows you to compare Mississauga investments with other markets, ensuring you put your money where it works hardest.

The easiest way to figure out yield is to divide the yearly rent by the property’s purchase price and then multiply the result by 100.

vbnet

CopyEdit

Gross Rental Yield is calculated by dividing the annual rent by the property price and then multiplying by 100.

Example:

If a property rents for $2,400 per month, annual rent equals $28,800. If the purchase price is $960,000:

java

CopyEdit

Gross Yield = (28,800 ÷ 960,000) × 100 = 3.0%

This method lets you calculate rental yield quickly, but it does not take operating expenses into account.

Net yield takes expenses into account, giving you a more realistic picture of actual profit.

vbnet

CopyEdit

Net Rental Yield is worked out by subtracting annual expenses from annual rent, dividing that figure by the property price, and multiplying by 100.

If expenses such as taxes, insurance, and maintenance total $8,000 per year:

java

CopyEdit

Net Yield = ((28,800 – 8,000) ÷ 960,000) × 100 = 2.15%

Investors who calculate rental yield using this method make smarter decisions because they know exactly what they will keep after costs.

Both figures have value. Gross yield is useful for a quick comparison when evaluating several properties at once. Several factors affect the result when you calculate yield: Net yield, however, is what serious investors rely on because it includes expenses. In Mississauga, where property taxes, condo fees, and maintenance costs can be substantial, net yield often paints a very different picture than gross yield. When you calculate rental yield, using both numbers helps you see both the potential and the real returns.

When you calculate yield, several elements influence the outcome:

Considering these factors when you calculate rental yield ensures a more accurate projection of profitability.

Rental yields in Mississauga typically fall between 3% and 5% for most residential properties. Condos may offer slightly higher gross yields due to lower purchase prices, but fees can reduce net income. Detached homes in desirable areas might have lower yields because of high prices, yet they attract long term tenants and strong resale value.

As of 2025, rents for a one bedroom apartment average around $2,000 per month, while larger homes command far higher rates. On the other hand, property prices frequently go over $1 million. When you calculate rental yield using these numbers, many properties fall in the 3% range, which is common for urban Canadian markets.

Online calculators make the process easier by automatically applying formulas. They allow you to input the purchase price, monthly rent, and expenses to get quick results. While convenient, they cannot account for local market nuances such as vacancy trends or future rent growth. For the most accurate assessment, use these tools as a starting point and then manually verify your calculations. Experienced investors always double check numbers when they calculate rental yield.

Improving rental yield is possible if you take a strategic approach:

Upgrade Wisely: Renovations that add value, like modern kitchens or energy efficient features, can justify higher rent.

Following these steps ensures that when you calculate rental yield, the numbers reflect strong returns.

Knowing how to calculate rental yield is fundamental for property investors. It helps you assess whether a property is worth the investment and how it compares to other opportunities. In Mississauga’s market, where prices are high but rental demand remains solid, accurate calculations allow you to avoid poor investments and focus on properties that deliver both income and long term value. By consistently applying this analysis, you can make informed choices and build a portfolio that performs well year after year.